Introduction

What is an HSA?

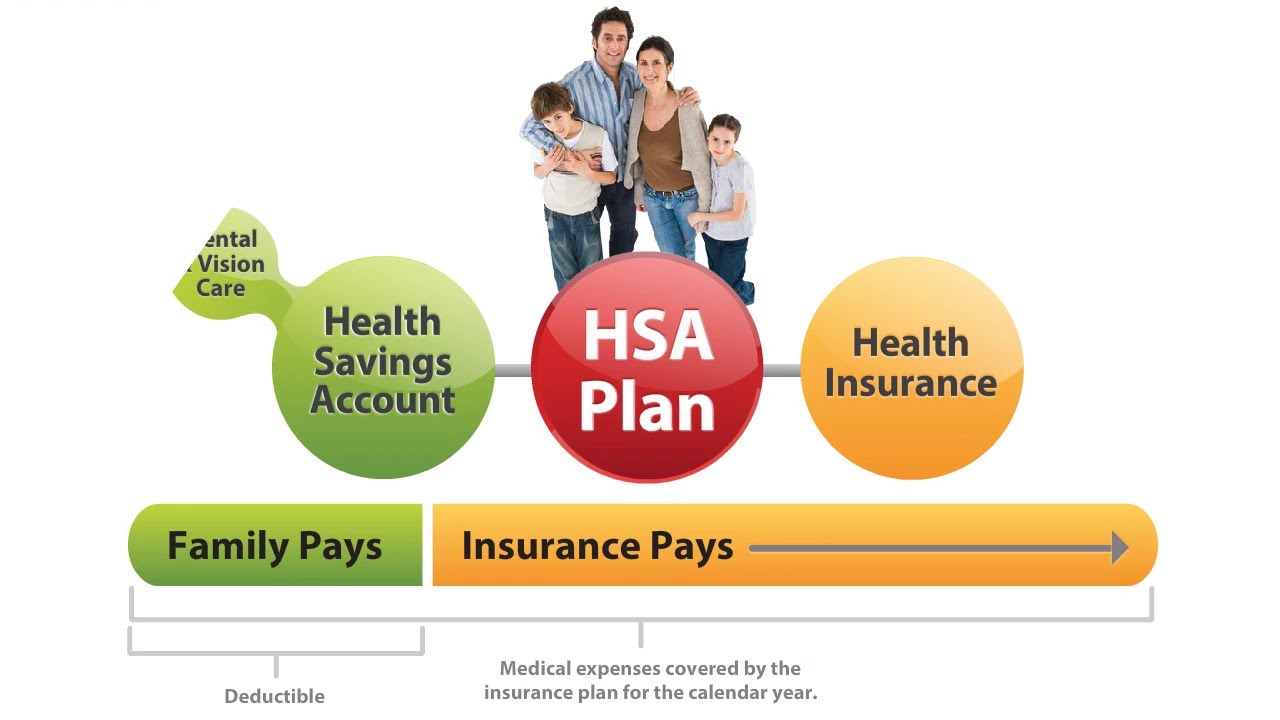

If you’re navigating the world of health savings accounts (HSAs) for the first time, you might be wondering, “What exactly is an HSA?” In simple terms, an HSA is a tax-advantaged savings account designed to help individuals with high-deductible health plans (HDHPs) save for medical expenses. Unlike flexible spending accounts (FSAs), the funds in an HSA roll over year to year, making them a versatile and powerful tool for managing healthcare costs.

Importance of Choosing the Right HSA Account

Choosing the right HSA account is crucial. It’s not just about having a place to park your money for medical expenses; the right HSA can also serve as a powerful investment vehicle and a way to save on taxes. But with so many options out there, how do you know which one is the best? That’s where understanding the key features of top HSA accounts comes in.

Overview of Top Features in HSA Accounts

In this blog post, we’ll dive into the top five features that make the best HSA accounts stand out. From low maintenance fees to investment options, ease of use, tax advantages, and flexible spending options, these features will help you maximize the benefits of your HSA.

Feature 1: Low Maintenance Fees

Why Low Fees Matter

When it comes to HSAs, every dollar counts. High maintenance fees can quickly eat into your savings, diminishing the account’s overall value. That’s why it’s important to choose an HSA provider that offers low or no fees. The less you pay in fees, the more money you can keep in your account to cover future medical expenses or grow through investments.

Types of Fees to Watch Out For

There are several types of fees associated with HSA accounts, including monthly maintenance fees, investment fees, and transaction fees. Monthly maintenance fees are charged just for having the account, while investment fees might be charged if you choose to invest your HSA funds. Some providers may also charge fees for transactions, such as withdrawals or transfers.

Examples of HSA Accounts with Low Fees

Some HSA providers stand out for their low or no fees. For instance, certain credit unions and online banks offer HSA accounts with no monthly maintenance fees and minimal investment fees. It’s worth shopping around and comparing the fee structures of different providers to ensure you’re getting the best deal.

Feature 2: Investment Options

Importance of Investment Opportunities in HSA Accounts

One of the most compelling reasons to choose an HSA is the ability to invest your funds. Unlike FSAs, which typically have a “use it or lose it” policy, HSAs allow you to roll over funds year after year, giving you the opportunity to grow your balance through investments. This feature can turn your HSA into a powerful long-term savings tool.

Types of Investment Options Available

The best HSA accounts offer a wide range of investment options, including mutual funds, ETFs, and even stocks. Some providers offer self-directed investment accounts, which allow you to take full control of where your money goes. This variety enables you to tailor your investment strategy to your personal risk tolerance and financial goals.

How to Maximize Returns with HSA Investments

To make the most of your HSA investments, it’s important to understand your investment options and how they align with your financial goals. Diversifying your portfolio and regularly reviewing your investment strategy can help you maximize returns. Additionally, take advantage of any educational resources offered by your HSA provider to stay informed and make smart investment decisions.

Feature 3: Ease of Use

Importance of User-Friendly Interfaces

An HSA account should be easy to manage. After all, no one wants to struggle with a clunky website or confusing interface when trying to manage their healthcare savings. The best HSA accounts come with user-friendly online portals and mobile apps that make it simple to check your balance, review transactions, and even make investments on the go.

Mobile Apps and Online Portals

In today’s digital world, having access to your HSA account via a mobile app is almost a necessity. The top HSA providers offer robust mobile apps that allow you to manage your account anytime, anywhere. Whether you need to pay a medical bill, transfer funds, or review your investment performance, the convenience of a mobile app cannot be overstated.

Customer Service and Support

Another key aspect of ease of use is the availability of customer support. Even the most intuitive accounts may occasionally require assistance, and having access to knowledgeable and responsive customer service can make a big difference. Look for HSA providers that offer multiple channels of support, such as phone, email, and chat.

Feature 4: Tax Advantages

Triple Tax Benefit Explained

One of the most attractive features of HSAs is the triple tax benefit they offer. Contributions to your HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. Additionally, any interest or investment earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This triple tax advantage makes HSAs one of the most tax-efficient savings accounts available.

How to Make the Most of HSA Tax Benefits

To fully capitalize on the tax benefits of an HSA, consider maximizing your annual contributions, which are capped at a certain limit each year. If you’re over 55, you can also make additional catch-up contributions. Another strategy is to let your HSA funds grow over time by paying current medical expenses out of pocket and saving receipts for future reimbursement.

Common Mistakes to Avoid

While HSAs offer great tax benefits, there are some pitfalls to watch out for. For example, using HSA funds for non-qualified expenses before age 65 can result in taxes and a penalty. Additionally, failing to keep receipts for medical expenses can make it difficult to substantiate withdrawals if audited by the IRS. Staying informed about the rules and regulations can help you avoid these common mistakes.

Feature 5: Flexible Spending Options

Qualified Medical Expenses Overview

HSAs are primarily designed to cover qualified medical expenses, which include things like doctor visits, prescription medications, and dental care. However, the list of eligible expenses is quite extensive, covering a wide range of healthcare needs. Knowing what qualifies can help you make the most of your HSA.

How to Use Your HSA for Non-Medical Expenses

While it’s generally best to use your HSA for qualified medical expenses, there may be times when you need to access the funds for other purposes. After age 65, you can withdraw HSA funds for any reason without penalty, though the amount will be subject to regular income tax if not used for medical expenses. This flexibility makes HSAs a valuable part of your overall financial planning strategy.

Carrying Over Funds Year to Year

One of the key advantages of HSAs over FSAs is that the funds roll over from year to year. There’s no pressure to spend down your balance before the end of the year, allowing you to build up a significant nest egg for future healthcare costs. This carryover feature makes HSAs an excellent tool for long-term savings.

Comparing HSA Providers

What to Look for in an HSA Provider

When comparing HSA providers, it’s important to consider several factors, including fees, investment options, ease of use, and customer service. You’ll want to choose a provider that aligns with your financial goals and offers the features that are most important to you.

Popular HSA Providers and Their Key Features

Some of the most popular HSA providers include Fidelity, HealthEquity, and Lively. Each of these providers offers unique features, such as low fees, a wide range of investment options, and user-friendly interfaces. By comparing the key features of these providers, you can find the one that best meets your needs.

How to Choose the Right Provider for Your Needs

Choosing the right HSA provider comes down to understanding your own financial situation and goals. Consider how much you plan to contribute, whether you want to invest your funds, and how you prefer to manage your account. Doing your homework and comparing your options will help you make an informed decision.

Real-Life Examples and Case Studies

Case Study 1: Maximizing HSA Investment Returns

Take the example of John, who began contributing to his HSA in his early 30s. By investing his funds in a diversified portfolio of mutual funds and consistently making the maximum contribution each year, John was able to grow his HSA balance significantly. By the time he reached his 50s, his HSA had become a substantial part of his retirement savings.

Case Study 2: Avoiding Common HSA Mistakes

Sarah, on the other hand, made the mistake of using her HSA funds for non-qualified expenses without realizing the tax consequences. This resulted in unexpected penalties and taxes, which could have been avoided with a better understanding of the rules. Learning from Sarah’s experience can help others avoid similar pitfalls.

How Different People Use Their HSA Accounts

People use their HSAs in a variety of ways. Some use it strictly for current medical expenses, while others treat it as an investment vehicle for future healthcare costs. Understanding how different people approach their HSA can provide valuable insights and ideas for managing your own account.

How to Open an HSA Account

Steps to Open an HSA

Opening an HSA is a straightforward process, but it’s important to follow the right steps. First, ensure that you’re eligible for an HSA by having a high-deductible health plan (HDHP). Then, choose an HSA provider that meets your needs and complete the application process, which typically involves providing personal information and selecting your contribution amount.

Documents You’ll Need

When opening an HSA, you’ll need to provide certain documents, such as proof of your HDHP coverage and identification. Some providers may also require you to complete a beneficiary designation form, which ensures that your HSA funds are distributed according to your wishes in the event of your death.

Tips for Getting Started

Once your HSA is open, consider setting up automatic contributions from your paycheck or bank account to make saving easy and consistent. It’s also a good idea to familiarize yourself with your provider’s online portal or mobile app so you can easily manage your account.

Who Should Consider an HSA Account?

Ideal Candidates for an HSA

HSAs are a great option for individuals who are enrolled in a high-deductible health plan and want to save for future medical expenses while enjoying tax advantages. They’re also ideal for those who are looking for an additional way to save for retirement, as HSA funds can be used for non-medical expenses after age 65.

HSAs for Families vs. Individuals

Whether you’re single or have a family, an HSA can be a valuable tool. For families, HSAs offer the flexibility to cover a wide range of medical expenses, from routine check-ups to unexpected emergencies. Individuals can benefit from the tax savings and investment opportunities, making HSAs a versatile option for a variety of healthcare needs.

Considering Age, Health, and Income

When deciding whether an HSA is right for you, consider your age, health status, and income. Younger individuals with few medical expenses may benefit from the long-term growth potential of an HSA, while those with higher incomes can take advantage of the tax savings. On the other hand, individuals with significant ongoing medical expenses may need to carefully weigh the benefits of an HSA against other healthcare savings options.

Common Misconceptions About HSAs

Myth 1: HSAs Are Only for the Wealthy

One common misconception is that HSAs are only beneficial for wealthy individuals. In reality, HSAs offer valuable tax advantages and savings opportunities for a wide range of people, regardless of income level. By taking advantage of the tax benefits and investing options, anyone can use an HSA to save for future healthcare costs.

Myth 2: HSAs Are Only for High Medical Expenses

Another myth is that HSAs are only useful for those with high medical expenses. While HSAs are designed to cover qualified medical expenses, they can also serve as a long-term savings and investment vehicle. Even if you don’t have significant medical expenses now, an HSA can help you save for the future.

Myth 3: HSAs Are Too Complicated to Use

Some people shy away from HSAs because they believe they’re too complicated. However, with a little bit of research and the right provider, managing an HSA can be straightforward. Many providers offer resources and tools to help you understand how to use your HSA effectively, making it easier to navigate.

Future Trends in HSA Accounts

Growth of HSAs in the U.S.

HSAs are growing in popularity in the U.S., with more people recognizing the benefits of these accounts. As healthcare costs continue to rise, HSAs provide a valuable way for individuals to save for future expenses while enjoying tax advantages. This growth is expected to continue as more employers offer HDHPs and HSAs as part of their benefits packages.

How Technology is Shaping HSAs

Technology is playing a significant role in shaping the future of HSAs. With the rise of mobile apps and online portals, managing an HSA has become more convenient than ever. Additionally, advancements in fintech are making it easier to invest HSA funds, providing more options for account holders to grow their savings.

The Impact of Legislation on HSAs

Legislation can have a big impact on HSAs, from changes in contribution limits to new rules governing how HSAs can be used. Staying informed about legislative changes is important for anyone with an HSA, as these changes can affect how you manage your account and plan for the future.

Maximizing Your HSA Benefits

Strategies for Regular Contributions

One of the best ways to maximize your HSA benefits is to make regular contributions. Whether you choose to contribute monthly, quarterly, or annually, consistent contributions can help you build up your balance over time. Additionally, consider making the maximum allowable contribution each year to take full advantage of the tax benefits.

How to Plan for Future Healthcare Costs

Planning for future healthcare costs is a key part of managing your HSA. Consider factors like your age, health status, and family history when estimating future expenses. By thinking ahead and saving accordingly, you can ensure that you have enough funds in your HSA to cover both expected and unexpected medical costs.

Integrating HSA with Other Retirement Accounts

HSAs can be a valuable addition to your retirement savings strategy. By integrating your HSA with other retirement accounts, such as a 401(k) or IRA, you can create a comprehensive plan for your financial future. This integration can help you maximize your savings and ensure that you’re prepared for healthcare expenses in retirement.

Challenges and Pitfalls of HSAs

Understanding the Risks

While HSAs offer many benefits, it’s important to understand the risks. For example, if you withdraw funds for non-qualified expenses before age 65, you’ll face taxes and penalties. Additionally, the value of your investments can fluctuate, which could impact your savings. Being aware of these risks can help you make informed decisions about your HSA.

Overcoming Common HSA Challenges

Common challenges with HSAs include understanding the rules and regulations, managing investments, and keeping track of receipts for medical expenses. However, with the right tools and resources, these challenges can be overcome. Many HSA providers offer educational materials and support to help you navigate these aspects of your account.

Staying Informed About Changes in HSA Policies

HSA policies can change over time, so it’s important to stay informed. Whether it’s new legislation affecting contribution limits or updates to the list of qualified medical expenses, staying on top of changes can help you make the most of your HSA. Consider subscribing to newsletters or following trusted sources for the latest information.

Conclusion

Recap of the Top Features of HSA Accounts

In summary, the best HSA accounts offer low maintenance fees, a wide range of investment options, ease of use, significant tax advantages, and flexible spending options. These features make HSAs a powerful tool for saving on healthcare costs and planning for the future.

Final Thoughts on Choosing the Best HSA

Choosing the right HSA account is a personal decision that depends on your individual needs and financial goals. By understanding the key features of top HSA accounts, you can make an informed decision and choose a provider that aligns with your priorities.

Encouragement to Take Action

If you haven’t already, now is a great time to consider opening an HSA or reviewing your current account. With the right strategy, an HSA can provide valuable benefits both now and in the future. Take action today to ensure that you’re making the most of your healthcare savings.

FAQs

What is the main benefit of having an HSA?

The main benefit of having an HSA is the triple tax advantage it offers. Contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSAs a highly tax-efficient way to save for healthcare costs.

Can I use my HSA to pay for non-medical expenses?

Yes, you can use your HSA to pay for non-medical expenses, but there are consequences. If you’re under 65, you’ll have to pay taxes on the withdrawal and a 20% penalty. After age 65, you can withdraw funds for non-medical expenses without penalty, though the amount will be subject to regular income tax.

How do I choose the right HSA provider?

Choosing the right HSA provider involves considering factors such as fees, investment options, ease of use, and customer service. Compare different providers to find one that offers the features that are most important to you and aligns with your financial goals.

What happens to my HSA if I change jobs?

If you change jobs, your HSA is yours to keep. You can continue to use the funds for qualified medical expenses or transfer the account to a new provider. Additionally, you can continue to make contributions to your HSA as long as you’re enrolled in a high-deductible health plan.

Is an HSA the right choice for me?

An HSA might be the right choice if you’re enrolled in a high-deductible health plan and want to save for future medical expenses while enjoying tax advantages. Consider your healthcare needs, financial goals, and risk tolerance when deciding whether an HSA is right for you.